India’s manufacturing sector development fell to a three-month low in May, restricted by inflationary pressures, softer demand and heightened geopolitical situations, a month-to-month survey stated on Monday(PTI)

Besides, the Russian-Ukraine battle, sharp leap in Brent crude oil costs and international fund outflows dented traders’ sentiment, specialists famous.

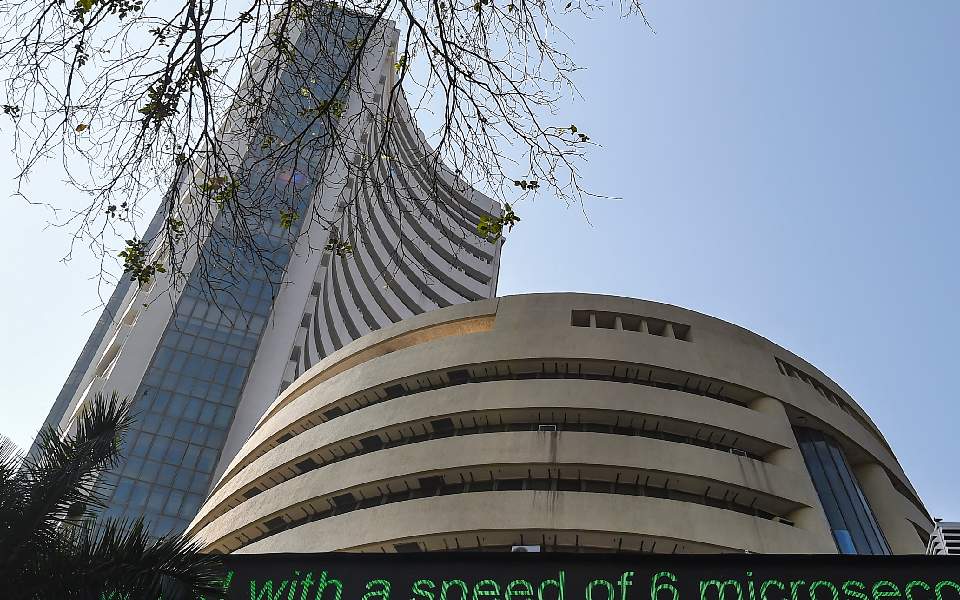

After tumbling 796.75 factors or 0.97 per cent to 80,654.26 in intra-day commerce, the 30-share BSE Sensex witnessed unstable traits and later ended 77.26 factors or 0.09 per cent decrease at 81,373.75.

The NSE Nifty dipped 34.10 factors or 0.14 per cent to settle at 24,716.60. During the day, it dropped 224.55 factors or 0.90 per cent to 24,526.15.

From the Sensex corporations, Tech Mahindra, Tata Steel, Tata Motors, Titan, HDFC Bank, IndusInd Bank, Infosys and Kotak Mahindra Bank have been among the many greatest laggards.

On the opposite hand, Adani Ports, Mahindra & Mahindra, Power Grid, Eternal and Hindustan Unilever have been among the many gainers.

In Asian markets, Japan’s Nikkei and Hong Kong’s Hang Seng settled decrease, whereas South Korea’s Kospi resulted in optimistic territory. Markets in China have been closed for a vacation.

European markets have been buying and selling decrease in mid-session offers. US markets ended on a blended word on Friday.

Foreign Institutional Investors (FIIs) offloaded equities value ₹6,449.74 crore on Friday, in accordance with trade information.

US President Donald Trump on Friday stated he would double tariffs on metal and aluminium to 50 per cent.

“The home market continued its consolidation part for the third consecutive week, influenced by renewed considerations over a possible tariff struggle and escalating geopolitical tensions between Russia and Ukraine.

“While global uncertainties have led investors to adopt a risk-averse approach, the Indian market has demonstrated resilience, underpinned by robust institutional inflows and selective sectoral strength like FMCG, real estate, and financial stocks,” Vinod Nair, Head of Research, Geojit Investments Limited, stated.

Meanwhile, India’s manufacturing sector development fell to a three-month low in May, restricted by inflationary pressures, softer demand and heightened geopolitical situations, a month-to-month survey stated on Monday.

The seasonally adjusted HSBC India Manufacturing Purchasing Managers’ Index (PMI) fell from 58.2 in April to 57.6 in May, highlighting the weakest enchancment in working situations since February.

Supportive home macro indicators embrace a possible RBI fee minimize, a greater monsoon, This fall GDP information and higher GST assortment, Nair added.

Indian economic system expanded at a sooner tempo than anticipated within the final quarter of the 2024-25 fiscal, serving to clock a 6.5 per cent development fee within the 12 months that elevated its dimension to USD 3.9 trillion and held promise of crossing the world’s fourth-largest economic system Japan in FY26.

The Indian economic system grew at 7.4 per cent in January-March – the fourth and closing quarter of April 2024 to March 2025 fiscal (FY25) – reflecting a powerful cyclical rebound that was helped by an increase in personal consumption and strong development in building and manufacturing.

Gross GST collections remained above the ₹2 trillion mark for the second straight month, rising 16.4 per cent in May to over ₹2.01 lakh crore.

Global oil benchmark Brent crude jumped 3.28 per cent to USD 64.84 a barrel.

On Friday, the BSE Sensex declined by 182.01 factors or 0.22 per cent to settle at 81,451.01. The Nifty dipped 82.90 factors or 0.33 per cent to 24,750.70.

This story has been revealed from a wire company feed with out modifications to the textual content. Only the headline has been modified.

No Comment! Be the first one.